dupage county sales tax calculator

County Farm Road Wheaton IL 60187. Find your Illinois combined state and local tax rate.

Dupage County Has No County-Level Sales Tax.

. The Illinois Department of Revenue annually provides DuPage County and the Township Assessors with an official measurement of the relationship between the assessed values and the fair cash values. DuPage County collects on average 171 of a propertys assessed fair market value as property tax. Local tax rates in Illinois range from 0 to 475 making the sales tax range in Illinois 625 to 11.

Measure the Initial 2019 DuPage County Level of Assessment before Township Revisions. Sales taxes in illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. Has impacted many state nexus laws and sales tax.

Higher maximum sales tax than 97 of Illinois counties. The Dupage County sales tax rate is. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

This measurement as required by law was built upon. Depending on local municipalities the total tax rate can be as high as 11. Interactive Tax Map Unlimited Use.

The Dupage County sales tax rate is. Even though your tax rate may have decreased the amount of taxes you owe can increase if the taxing bodies ask for more money. Whether you are already a resident or just considering moving to DuPage County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. This rate includes any state county city and local sales taxes. The median property tax on a 31690000 house is 332745 in the United States.

The part of naperville in dupage county had a 2005 tax rate of 57984. This is the total of state and county sales tax rates. 6089 Miller Lane Dupage City IL 60532.

In dupage county its 675 percent and in lake. The Illinois sales tax of 625 applies countywide. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other counties around the United States. The median property tax on a 31690000 house is 548237 in Illinois. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes. The 2018 United States Supreme Court decision in South Dakota v. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in DuPage County.

County Farm Road Wheaton IL 60187 630-407-6500. Oak Brook Sales Tax. IL Rates Calculator Table.

The Illinois IL state sales tax rate is currently 625. Illinois has a 625 statewide sales tax rate but also has 495 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1904 on. US Sales Tax Rates IL Rates Sales Tax Calculator Sales Tax Table.

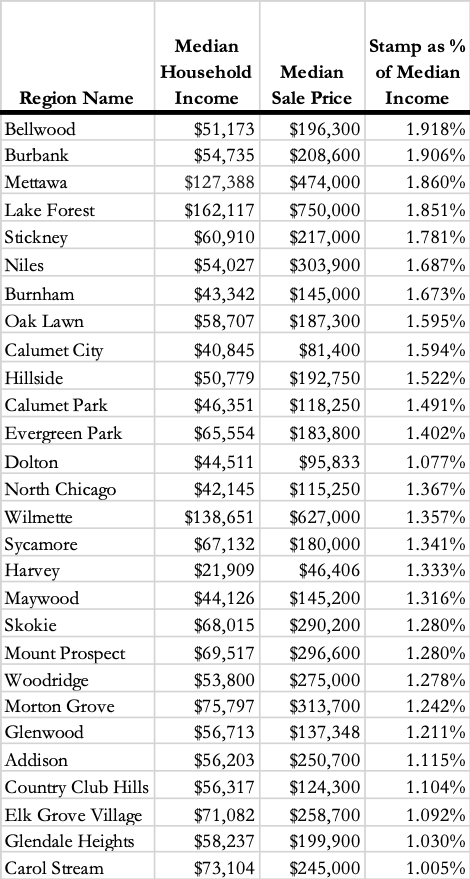

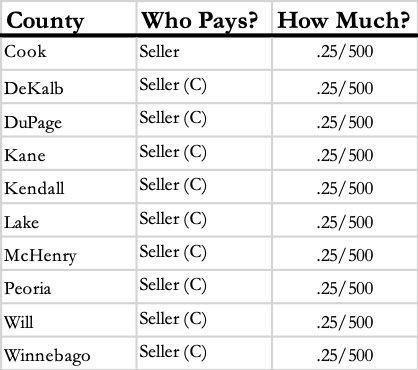

Counties may impose a tax of 25 cents per 500 of value on real estate transactions. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900. Learn all about DuPage County real estate tax.

The Illinois state sales tax rate is currently. Tax allocation breakdown of the 7 percent sales tax rate on General. DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments for Community Services Homeland Security Public Works Stormwater DOT Convalescent Center.

Ad Lookup Sales Tax Rates For Free. Illinois sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Other local-level tax rates in the state of Illinois include home rule non-home rule water commission mass transit park district business district county public safety public facilities or transportation and county school facility tax.

Cook county 3681 tax assessor. US Sales Tax Rates IL Rates. The base state sales tax rate in Illinois is 625.

The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. The base sales tax rate in DuPage County is 7 7 cents per 100. The December 2020 total local sales tax rate was also 7000.

The current total local sales tax rate in DuPage County IL is 7000. 2020 rates included for use while preparing your income tax deduction. The sales tax in chicago.

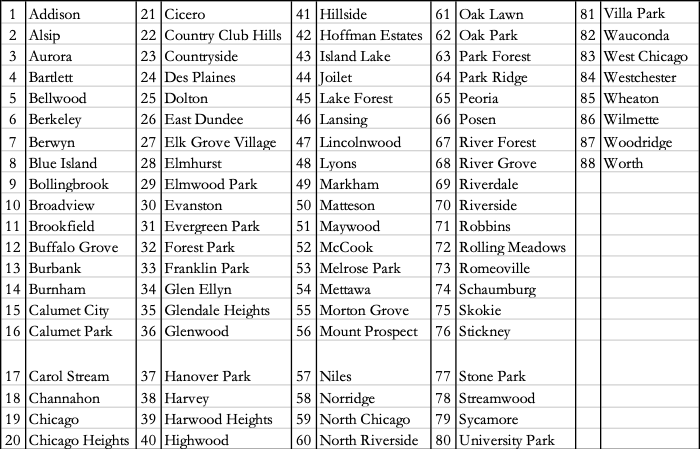

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Property Tax Village Of Carol Stream Il

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Income Tax Calculator Smartasset

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

How To Calculate Sales Tax Definition Formula Example

Illinois Sales Tax Rates By City County 2022

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Illinois Income Tax Calculator Smartasset

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Naperville Business Tax Attorney Dupage County Corporate Tax Planning Lawyer Il

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates